In today’s fast-paced and ever-changing financial markets, staying ahead of the curve is crucial for investors and traders. That’s where AI-powered trading bots come into play. These innovative tools leverage the power of artificial intelligence and machine learning algorithms to help individuals make more informed trading decisions. And that helps to boost their revenue. However, it’s important to note that using AI bots in real-money transactions carries inherent risks. Therefore, the traders that use AI bots must be careful.

What is an AI trading bot?

An AI trading bot is a sophisticated software application that uses advanced algorithms and machine learning techniques. And it can analyze large amounts of data and generate better trading signals. These bots can automatically execute trades, monitor market conditions, and adapt their strategies based on real-time information. With AI bots, traders have the potential to gain valuable insights into market trends and identify profitable opportunities. And they can use that knowledge to execute perfect trades with precision.

While the capabilities of AI trading bots are impressive, it’s crucial to understand that they are not infallible. The use of AI bots in trading introduces risks that traders need to be aware of. Market conditions can change rapidly, and past performance is not a guarantee of future success. Traders need to exercise caution and thoroughly understand the strategies employed by AI bots. Also, carefully assess their risk tolerance before engaging in real-money transactions.

Please note that the information provided here is for educational purposes only and should not be considered financial advice. Trading in financial markets involves inherent risks. And it’s advisable to consult with a qualified financial professional before making any investment decisions.

By acknowledging the potential benefits and risks of using AI-powered trading bots, traders can make more informed decisions and take advantage of the advanced capabilities of these tools. It’s essential to approach AI bots as valuable aids in the trading process. But always maintain an understanding of the inherent risks and exercise careful judgment when engaging in financial transactions.

Here are the five best AI Trading bots that we identified by using each of them.

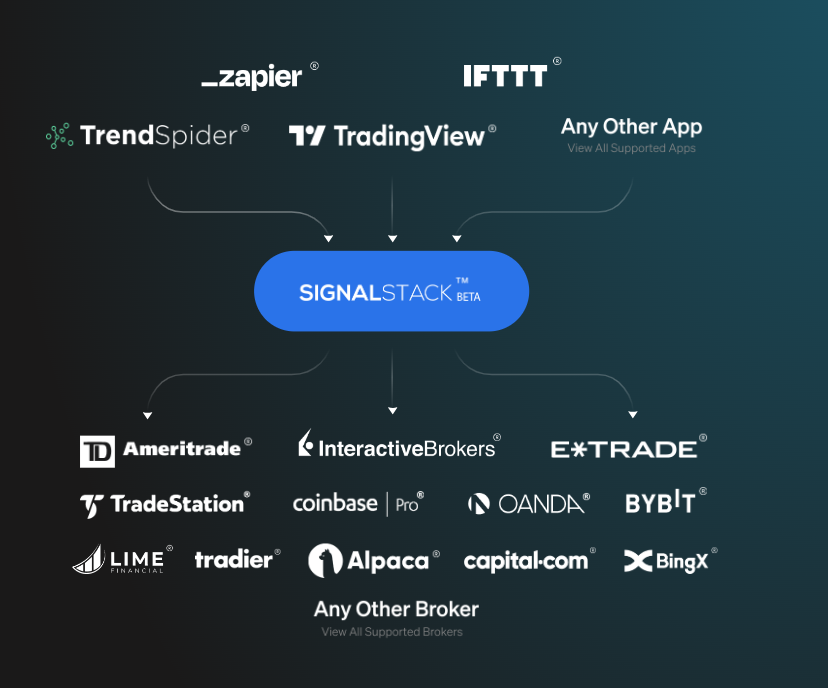

SignalStack – Automating Your Trades with Ease

SignalStack is a powerful AI-powered trading bot that simplifies the process of converting alerts into executed orders in your brokerage account. SingalStack has integrated with various trading platforms and it comes with a user-friendly interface. And it allows you to automate your trades seamlessly.

By adjusting the payload sent to SignalStack, you can place market and limit orders automatically, minimizing slippage. Additionally, the platform keeps detailed logs of all interactions with outside brokers and can send you automated alerts upon any exception. Also, it has a free tier that you can use to test it. You don’t need credit card details for that.

Trade Ideas – Unleashing the Power of Data Analysis

Trade Ideas is an AI-powered trading bot that harnesses the power of data analysis to uncover profitable trading opportunities. With its advanced scanning capabilities and real-time market data, This AI trading bot helps traders identify potential winning trades. The platform uses machine learning algorithms to continuously analyze vast amounts of market data, historical patterns, and technical indicators.

It then generates trading signals and alerts, empowering traders to make informed decisions. It offers a variety of features, including backtesting, custom strategy development, and real-time market scanning.

Robinhood’s AI Trading – Accessible Trading for All

Robinhood’s AI Trading is an AI-powered trading bot designed to make trading accessible to all individuals. With its intuitive interface and user-friendly mobile app, Robinhood allows users to trade stocks, options, and cryptocurrencies with ease.

The platform leverages AI algorithms to provide personalized investment recommendations and insights based on a user’s trading history and preferences. Robinhood’s AI Trading also offers features such as fractional shares, automated dividend reinvestment, and commission-free trades. All those features make this bot a popular choice among new comers.

Trend Spider – Technical Analysis at Your Fingertips

Trend Spider is an AI-powered trading bot that specializes in technical analysis. It empowers traders with advanced charting tools and machine learning algorithms. It enables them to identify key trends, support and resistance levels, and potential entry and exit points for their trades.

The platform automatically analyzes complex chart patterns and indicators, saving traders valuable time and effort. Trend Spider also offers backtesting capabilities, allowing traders to evaluate the performance of their trading strategies using historical data.

LuxAlgo – Next-gen stock trading

LuxAlgo v2 is a manual trading system built on the TradingView platform, designed for traders with market knowledge. Trading inherently carries risks. Therefore, it is crucial to understand the trading signals provided by LuxAlgo. So we recommend you to start it with the demo account. One of the key advantages of LuxAlgo is its flexibility. It allows users to apply it to various instruments and timeframes, accommodating trade ideas for short, mid, and long-term positions.

To optimize results, it is essential to develop a solid trading plan, maintain discipline, and implement effective money management strategies. Remember, successful trading requires a combination of skill, knowledge, and prudent decision-making. It’s important to approach Lux Algo or any trading system with caution and to always be mindful of the risks involved.

By incorporating AI-powered trading bots into their trading strategies, investors and traders can gain valuable insights, automate their trades, and potentially boost their revenue. However, it’s essential to remember that trading in financial markets involves inherent risks, and the use of AI bots introduces additional complexities.

Traders must exercise caution, thoroughly understand the strategies employed by these bots, and carefully assess their risk tolerance. By acknowledging the potential benefits and risks, traders can leverage the power of AI bots to enhance their trading experience. So, they can stay ahead in the evolving world of finance.